Prop firm with live trading opportunities

Take profit from your trading strategies with no capital at risk

90% profit split - Free Trading Platform - Eurex & CME futures

The most reliable prop firm for payouts

Backed by real traders and asset managers

Zenit Provides you the security of guaranteed payouts along with job opportunities in trading firm

How does it work?

1

Choose a Zenit account

2

Create your Zenit account on our website

3

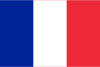

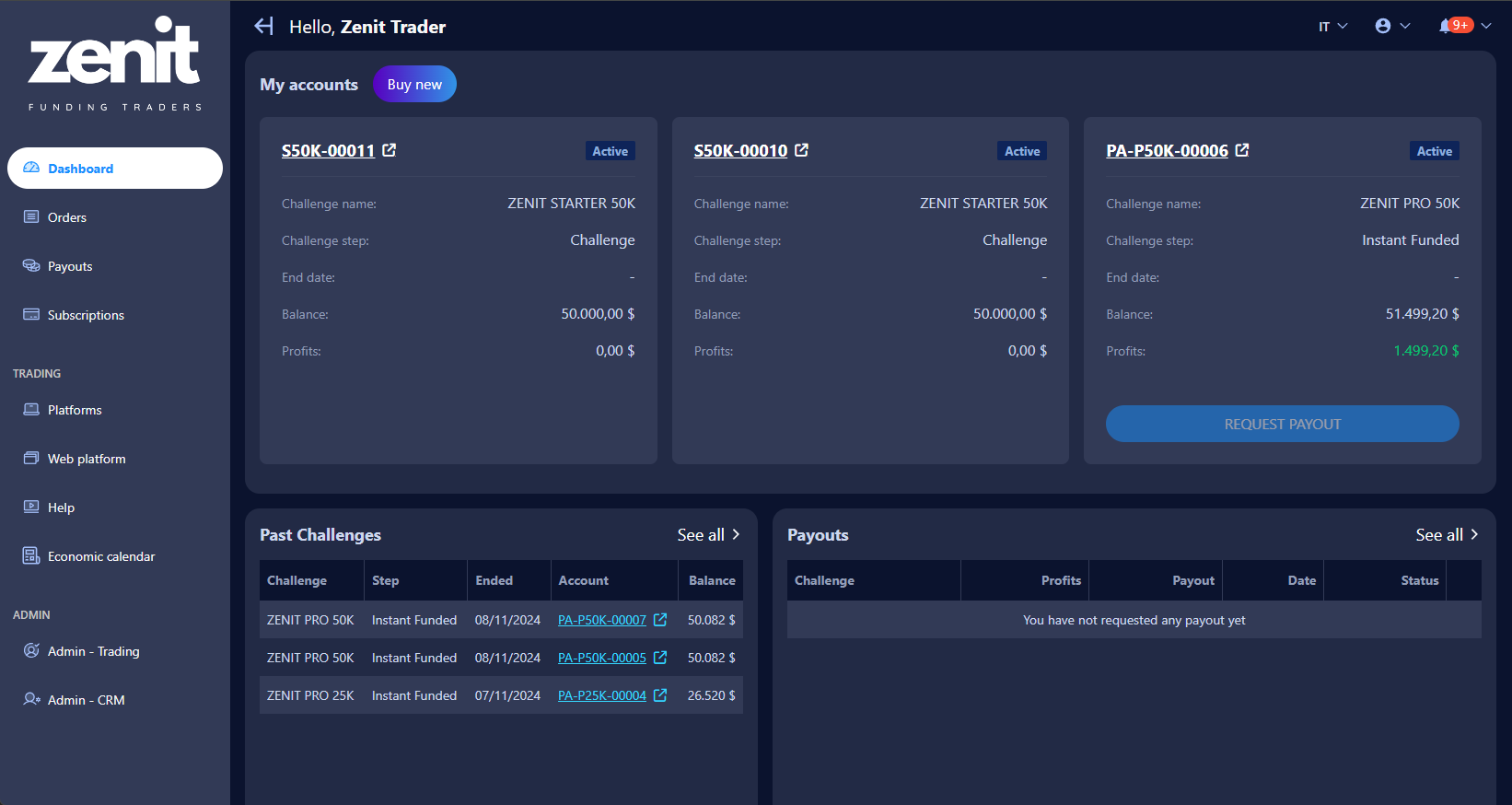

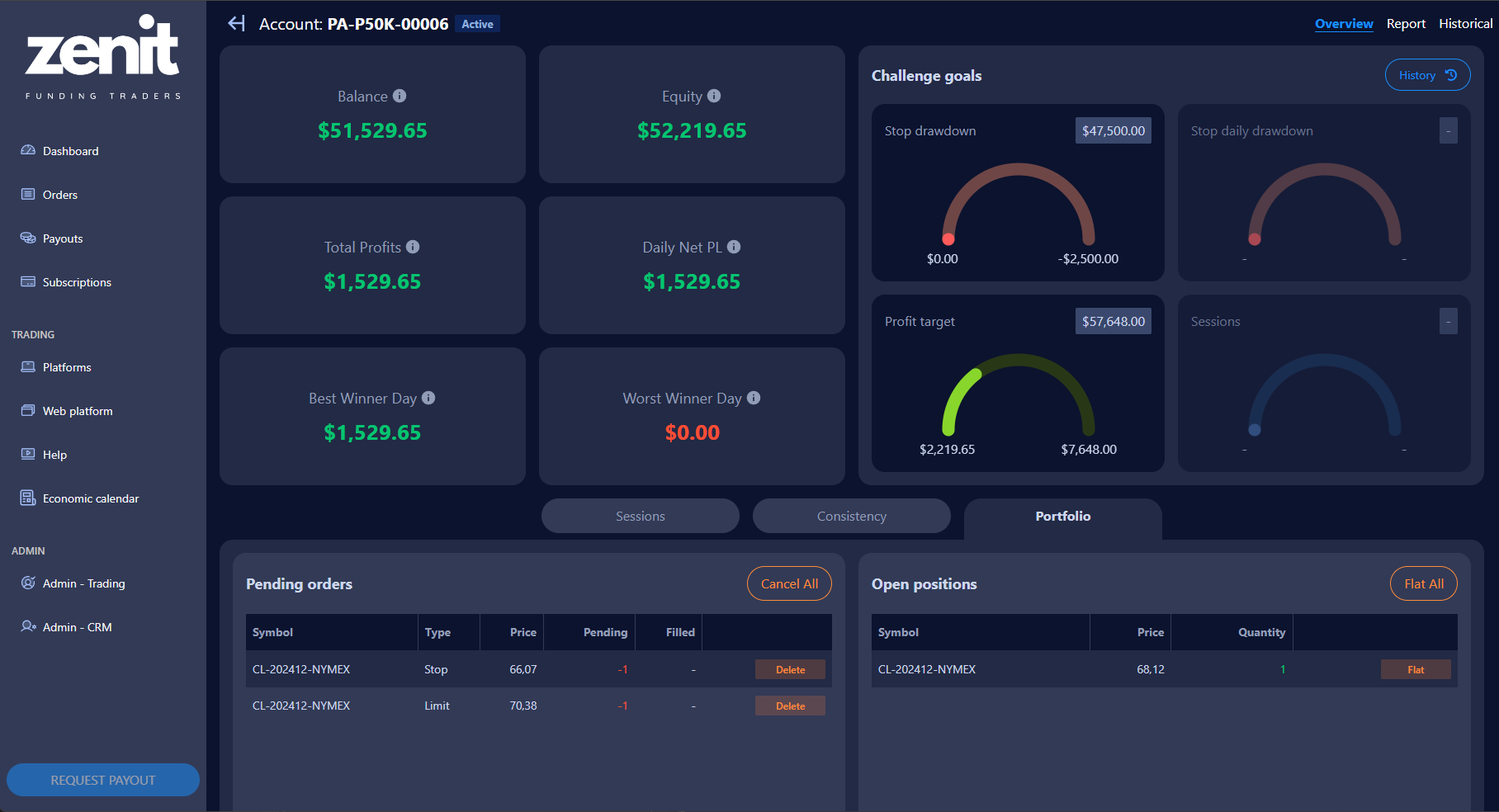

Access your dashboard

4

Trade via our integrated platform or connect your favorite platform

Choose your Zenit trading plan

Limited promo (70% coupon): SAVE70

$165

$49.5

/ monthly

$50k

Buy plan

Challenge

Profit Target: $3,000

Trailing Drawdown: $2,500

Minimum number of days: 2

Maximum active accounts: 5

Funded *

Trailing Drawdown: $2,500

Minimum account balance: $50,100

Safety Net: $2,500

Consistency: 30%

Minimum number of days: 10

Minimum profit per day: $150

Minimum payout: $500

Maximum payout: $1,600

Maximum active accounts: 3

Data feed: CME Bundle L1

Platform: included

MOST POPULAR

$399

$119.7

/ monthly

$150k

Buy plan

Challenge

Profit Target: $9,000

Trailing Drawdown: $5,000

Minimum number of days: 2

Maximum active accounts: 5

Funded *

Trailing Drawdown: $5,000

Minimum account balance: $150,100

Safety Net: $5,000

Consistency: 30%

Minimum number of days: 10

Minimum profit per day: $450

Minimum payout: $500

Maximum payout: $2,750

Maximum active accounts: 3

Data feed: CME Bundle L1

Platform: included

$659

$197.7

/ monthly

$300k

Buy plan

Challenge

Profit Target: $20,000

Trailing Drawdown: $7,500

Minimum number of days: 2

Maximum active accounts: 5

Funded *

Trailing Drawdown: $7,500

Minimum account balance: $300,100

Safety Net: $7,500

Consistency: 30%

Minimum number of days: 10

Minimum profit per day: $650

Minimum payout: $500

Maximum payout: $3,500

Maximum active accounts: 3

Data feed: CME Bundle L1

Platform: included

BENEFITS

1. Dedicated server and reliable data feed

With Zenit funding, you never experience connection issues anymore. We provide a reliable data feed with our dedicated server.

BENEFITS

2. Inbuilt Free Trading platform included

No need to connect to external platforms. You can trade directly from our powerful built -in trading platform. However, you can of course connect your favorite platform (Atas, Quantower or Volumetrica Trading).

BENEFITS

3. Live trading opportunities

Zenit funding is the first prop firm backed by real asset managers and traders. We offer you the opportunity to get live trading as a professional trader partner.

BENEFITS

4. Trade all futures markets(CME and Eurex)

We have access to all markets. With Zenit, you can trade all futures markets.

BENEFITS

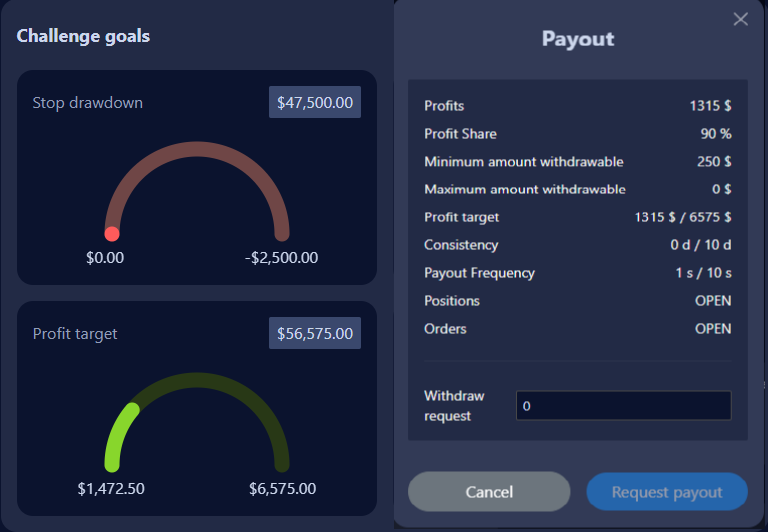

5.Fast and simple payout process

Leverage our advanced payout process. We guarantee fast and reliable payouts. Discover your amazing dashboard.

Clear rules, no confusion for payouts

Trade on your own terms, your strategy

We want no confusion on payout rules. So, we have built flexible rules that enables you to trade your own trading system.

Join the new generation

of prop firms

of prop firms

We provide a unique and professional approach to proprietary trading.

Different challenge types

Fast & simple payout

Eurex & CME Futures

Free trading platform

Dedicated server, reliable data feed

Clear and transparent rules

FAQ

Find answers to your questions

Depending on the chosen plans, there are different targets and drawdowns, you can find details in the different plans above or in the rules section.

We apply a trailing drawdown on all our accounts. This drawdown is calculated intraday, not at the end of the day and you should not reach that drawdown or your account will be liquidated

A "trailing drawdown" is linked to the positive performance of your account, which means that if you increase your profits by $1, your "trailing drawdown" will also increase by $1.

We apply a trailing drawdown on all our accounts. This drawdown is calculated intraday, not at the end of the day and you should not reach that drawdown or your account will be liquidated

A "trailing drawdown" is linked to the positive performance of your account, which means that if you increase your profits by $1, your "trailing drawdown" will also increase by $1.

On challenge accounts, there is no consistency rule.

On funded accounts, we apply a 30% consistency rule.

On funded accounts, we apply a 30% consistency rule.

When you are funded, you can trade maximum 3 accounts simultaneously.

In the challenge phase, you can trade a maximum of 5 accounts.

In the challenge phase, you can trade a maximum of 5 accounts.

You must complete 10 trading days and follow all the rules.

Each new payout request can only be made between the 1st and the 4th of the current month, and between the 16th and 20th of the current month.

Each new payout request can only be made between the 1st and the 4th of the current month, and between the 16th and 20th of the current month.

You can request 90% of your profits, we keep 10%.

Get funded with Zenit

Take profit from your trading strategies with no capital at risk